Africa Roundup: Zimbabwe’s net blackout, Partech’s $143M fund, Andela’s $100M raise, Flutterwave’s pivot

A high court in Zimbabwe ended the government’s restrictions on internet and social media last month.

After days of intermittent blackouts at the order of the country’s Minister of State for National Security, ISPs restored connectivity per a January 21 judicial order.

Similar to net shutdowns around the continent, politics and protests were the catalyst. Shortly after the government announced a dramatic increase in fuel prices on January 12, Zimbabwe’s Congress of Trade Unions called for a national strike.

Web and app blackouts in the southern African country followed demonstrations that broke out in several cities. A government crackdown ensued, with deaths reported.

On January 15, Zimbabwe’s largest mobile carrier, Econet Wireless,confirmed that it had complied with a directive from the Minister of State for National Security to shutdown internet.

Net access was restored, taken down again, then restored, but social media sites remained blocked through January 21.

Throughout the restrictions, many of Zimbabwe’s citizens and techies resorted to VPNs and workarounds to access net and social media, as reported in this TechCrunch feature.

Global internet rights group Access Now sprung to action, attaching its #KeepItOn hashtag to calls for the country’s government to reopen cyberspace soon after digital interference began.

The cyber-affair adds Zimbabwe to a growing list of African countries — including Cameroon, Congo and Ethiopia — whose governments have restricted internet expression in recent years.

It also provides another case study for techies and ISPs regaining their cyber rights. Internet and social media are back up in Zimbabwe — at least for now.

Further attempts to restrict net and app access in Zimbabwe will likely revive what’s become a somewhat ironic cycle for cyber shutdowns. When governments cut off internet and social media access, citizens still find ways to use internet and social media to stop them.

Partech doubled its Africa VC fund to $143 million and opened a Nairobi office to complement its Dakar practice.

The Partech Africa Fund plans to make 20 to 25 investments across roughly 10 countries over the next several years, according to general partner Tidjane Deme. The fund has added Ceasar Nyagha as investment officer for the Kenya office to expand its East Africa reach.

Partech Africa will primarily target Series A and B investments and some pre-series rounds at higher dollar amounts. “We will consider seed-funding — what we call seed-plus — tickets in the $500,000 range,” Deme told TechCrunch for this story on the new fund. Partech is open to all sectors “with a strong appetite for people who are tapping into Africa’s informal economies,” he said.

Partech Africa joined several Africa-focused funds over the last few years to mark a surge in VC for the continent’s startups. Partech announced its first raise of $70 million in early 2018 next to TLcom Capital’s $40 million, and TPG Growth’s $2 billion.

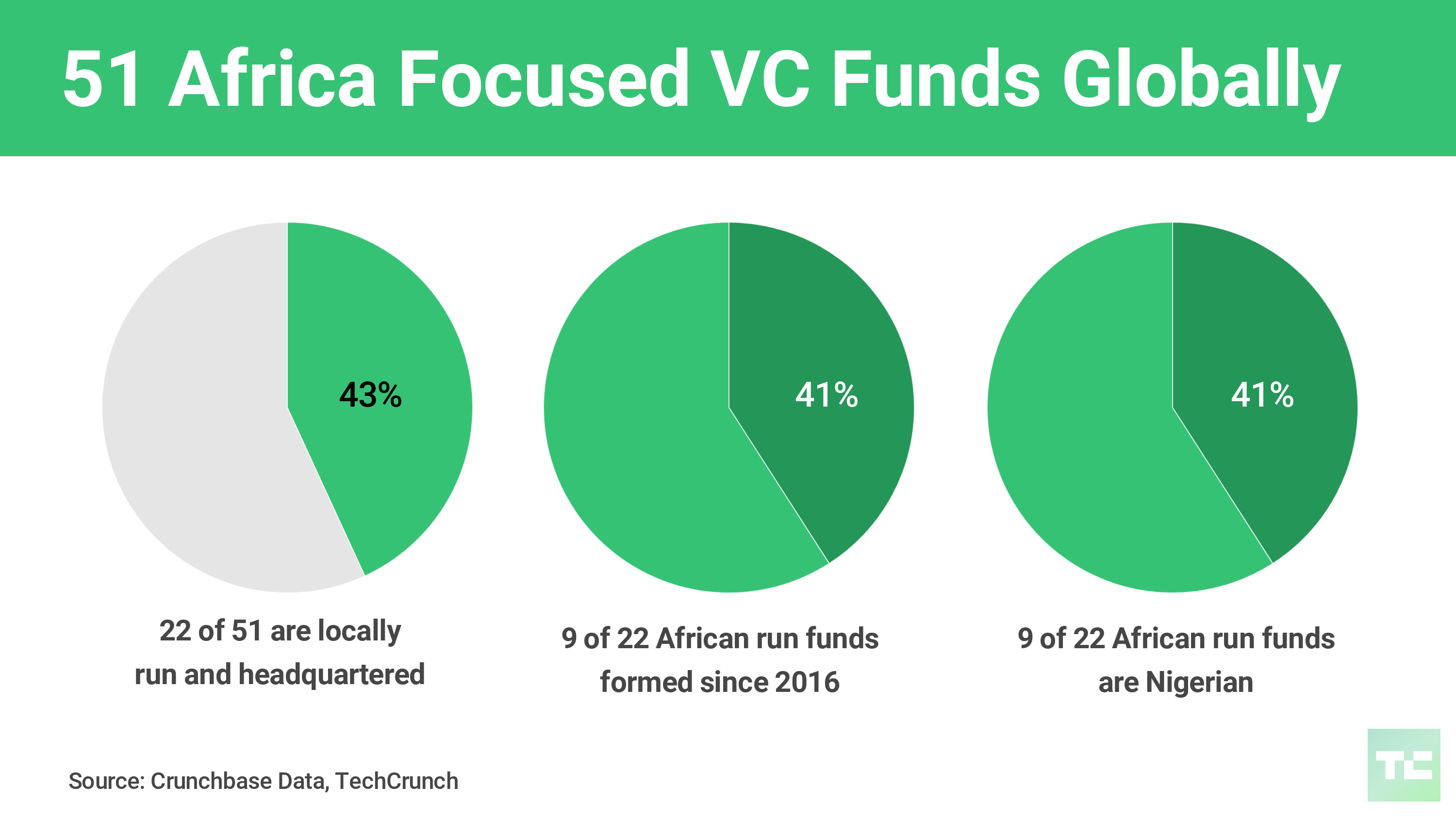

Africa-focused VC firms, including those locally run and managed, have grown to 51 globally, according to recent Crunchbase research.

Andela, the company that connects Africa’s top software developers with technology companies from the U.S. and around the world, raised $100 million in a new round of funding.

The new financing from Generation Investment Management (an investment fund co-founded by former VP Al Gore) puts the valuation of the company at somewhere between $600 million and $700 million—based on data available from PitchBook on the company’s valuation.

The company now has more than 200 customers paying for access to the roughly 1,100 developers Andelahas trained and manages.

With the new cash in hand, Andela says it will double in size, hiring another thousand developers, and invest in new product development and its own engineering and data resources. More on Andela’s recent raise and focus here at TechCrunch.

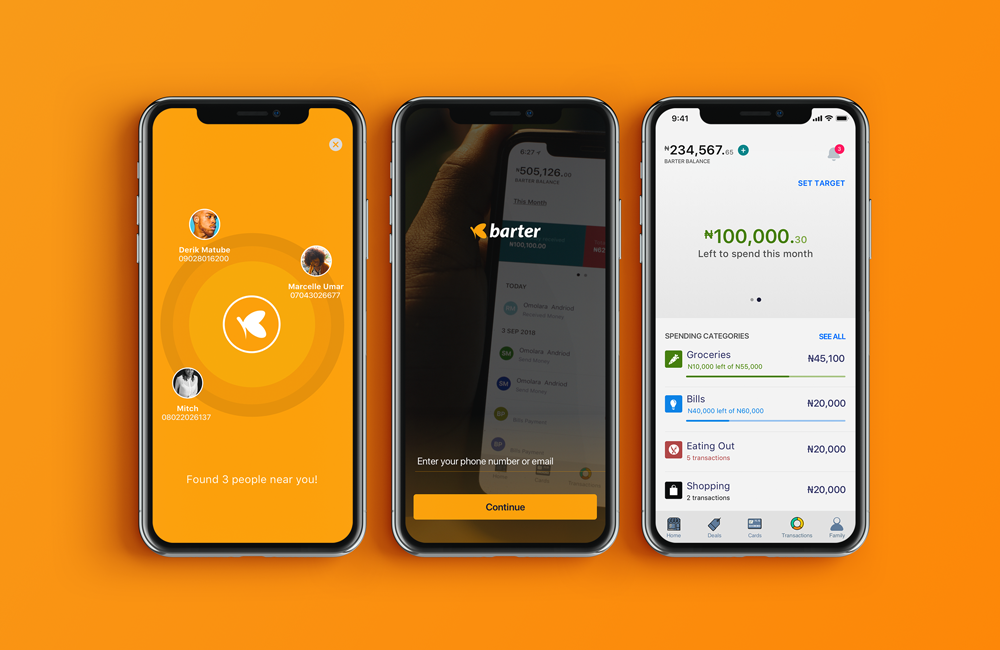

Fintech startup Flutterwave announced a new consumer payment product for Africa called GetBarter, in partnership with Visa.

The app-based offering is ai

Be the first to write a comment.