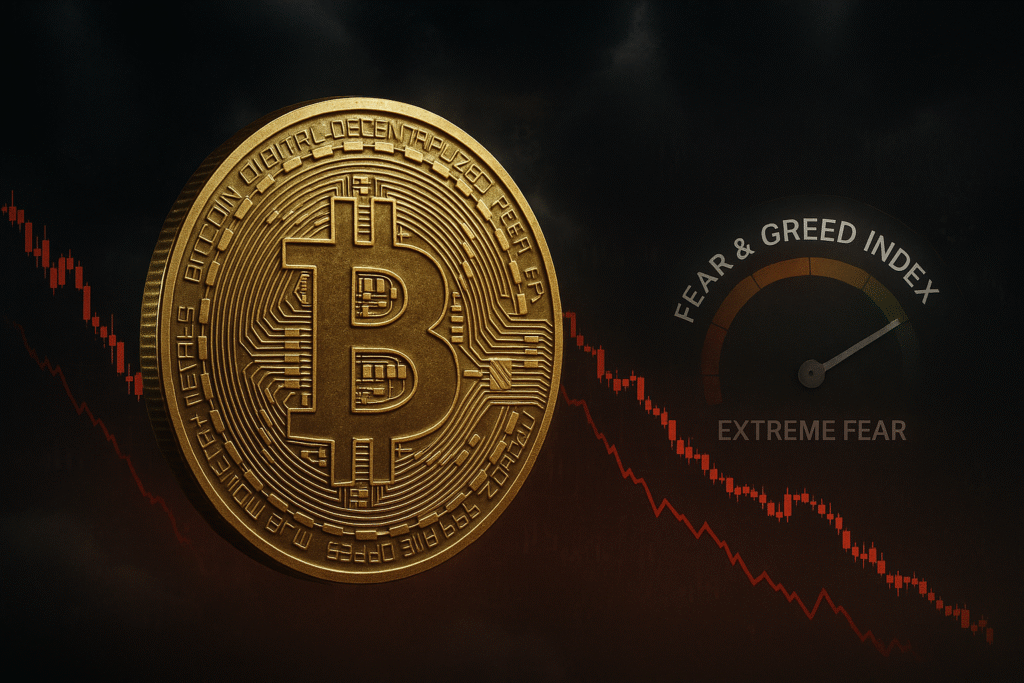

Bitcoin market sentiment turns to extreme fear as BTC sinks to $105k

- Bitcoin’s Fear & Greed Index drops to 22, signaling extreme fear in the crypto market.

- BTC falls 13% in a week to $105,600, triggering a sharp decline in investor sentiment.

- Extreme fear may hint at a potential market bottom, but uncertainty remains high.

The cryptocurrency market has entered a phase of heightened anxiety as the Bitcoin Fear & Greed Index drops into the “extreme fear” territory.

Following a sharp decline in Bitcoin and other major digital assets, investor sentiment has deteriorated markedly, raising questions about whether a market bottom could be near—or if more downside lies ahead.

Fear & Greed index falls to extreme levels

The Fear & Greed Index is designed to gauge investor sentiment in the Bitcoin and broader cryptocurrency markets.

It does so by aggregating data from multiple sources, including volatility, trading volume, market capitalization dominance, social media activity, and Google Trends.

The index operates on a scale of 0 to 100, with higher numbers indicating greed and lower numbers indicating fear.

Scores above 53 suggest traders are becoming greedy, while readings below 47 imply a fearful environment.

When the value falls under 25, it is considered “extreme fear,” and above 75, “extreme greed.”

As of now, the index stands at 22, firmly placing it in the extreme fear zone.

This marks a decline from recent readings that had shown only moderate fear, signaling that market sentiment has weakened significantly in a short period.

Bitcoin price drop drives market anxiety

The latest move into extreme fear coincides with a steep decline in Bitcoin’s price.

The world’s largest cryptocurrency has fallen sharply over the past several days, losing about 13% over the last week to trade around $105,600 at the time of writing.

This downturn follows a broader sell-off across the crypto market, with other digital assets also posting significant losses.

The sentiment shift has been rapid—just last week, the index recorded a similar low of 24 after a sudden market drawdown.

That earlier episode saw the index swing dramatically from greed to extreme fear within a short span, reflecting how quickly optimism can turn to caution in the volatile crypto environment.

The market’s current position mirrors past instances when sharp price corrections triggered widespread fear among investors.

Historically, such periods of extreme sentiment have often corresponded with significant market turning points, although not always in a straightforward manner.

Extreme fear as a possible turning point

While a reading of extreme fear can appear alarming, it has sometimes preceded market bottoms in Bitcoin’s history.

The relationship between sentiment and price has typically

Be the first to write a comment.