Calm Before the Storm Expected as Bitcoin Volatility Wakes Up

Calm Before the Storm Expected as Bitcoin Volatility Wakes Up

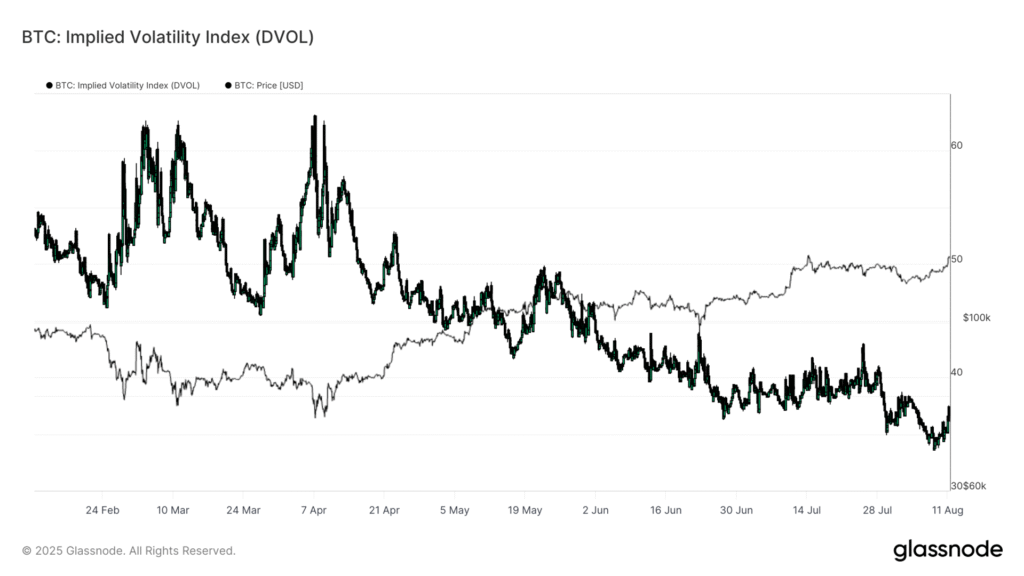

BTC’s implied volatility jumps from 33 to 37 after hitting multi-year lows, raising the odds of a bigger market move ahead.

What to know:

- DVOL index spikes to 37, up from last week’s 26% low, historically a precursor to sharp price swings.

- Spot-driven weekend rally from $116,000 to $122,000 suggests underlying strength as open interest trends lower.

Bitcoin’s (BTC) implied volatility (IV) has moved from 33 to 37 on Monday, a notable uptick from multi-year lows and a possible signal that the market’s long stretch of calm is nearing an end.

The Deribit Volatility Index (DVOL), modeled after the VIX in traditional markets, tracks the 30-day implied volatility of bitcoin options and now sits at its highest level in weeks.

Implied volatility represents the market’s forecast for price swings, calculated from option prices. In formal terms, IV measures the one-standard-deviation range of an asset’s expected movement over a year. Tracking at-the-money (ATM) IV offers a normalized view of sentiment, often rising and falling alongside realized volatility.

Last week, BTC’s short-term IV fell to around 26%, one of the lowest readings since options data began being recorded, before rebounding sharply. The last time volatility sat this low was August 2023, when bitcoin hovered near $30,000 shortly before a sharp move higher.

Over the weekend, bitcoin jumped from $116,000 to $122,000, hinting at what can happen when volatility starts to expand. August is traditionally a period of low volumes and muted market activity, but rising IV suggests traders may be positioning for larger moves ahead.

Checkonchain data shows this latest rally was a spot-driven move, which is a healthier market structure than a purely leverage-fueled surge. Open interest has been declining through August, meaning a sudden influx of leverage could amplify price swings if sentiment shifts.

Read more: Bitcoin Bulls Take Another Shot at the Fibonacci Golden Ratio Above $122K as Inflation Data Looms

James Van Straten

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).

More For You

Altcoin Season Could Begin in September as Bitcoin’s Grip on Crypto Market Weakens: Coinbase Institutional

Coinbase expects falling bitcoin dominance, improving liquidity and renewed investor appetite to shift gains toward altcoins starting in September.

What to know:

- Coinbase Institutional’s latest research report says September could mark the start of an altcoin season, citing three key market shifts.

- Falling bitcoin dominance and higher liquidity may drive altcoin outperformance.

- Renewed investor risk appetite could extend the rally into year-end.

Circle to Offer 10 Million Class A Shares at $130 Each

Hong Kong Regulator Tightens Custody Standards for Licensed Crypto Exchanges

Altcoin Season Could Begin in September as Bitcoin’s Grip on Crypto Market Weakens: Coinbase Institutional

Bullish Bets Lose $860M to Liquidations as ETH, BTC, XRP, DOGE Price Drop 9%

XRP Sheds 7% on $437M Sell Spike as $1B Liquidations Hit Crypto Market

Asia Morning Briefing: ETH’s Bullrun Meets Early Signs of Selling Pressure

Scott Bessent Suggests Government Bitcoin Purchases Remain a Possibility

Hong Kong Regulator Tightens Custody Standards for Licensed Crypto Exchanges

Crypto Slide Spurs $1B Leverage Flush, But It’s a Healthy Pullback, Analysts Say

Figment Outpaces Rivals in Ether Staking Growth, Lido’s Decline Eases Dominance Concerns

TeraWulf Jumps 22% on $3.7B AI Hosting Deal, With Google Taking 8% Stake

Who Is Cashing Out of Bitcoin at Record Highs Above $120K?

!–>!–>!–>!–>!–>!–>!–>!–>!–>!–>

Read More

Be the first to write a comment.