European Session Buying Lifts Bitcoin Cash to $491.80 After Breaking $487 Resistance

European Session Buying Lifts Bitcoin Cash to $491.80 After Breaking $487 Resistance

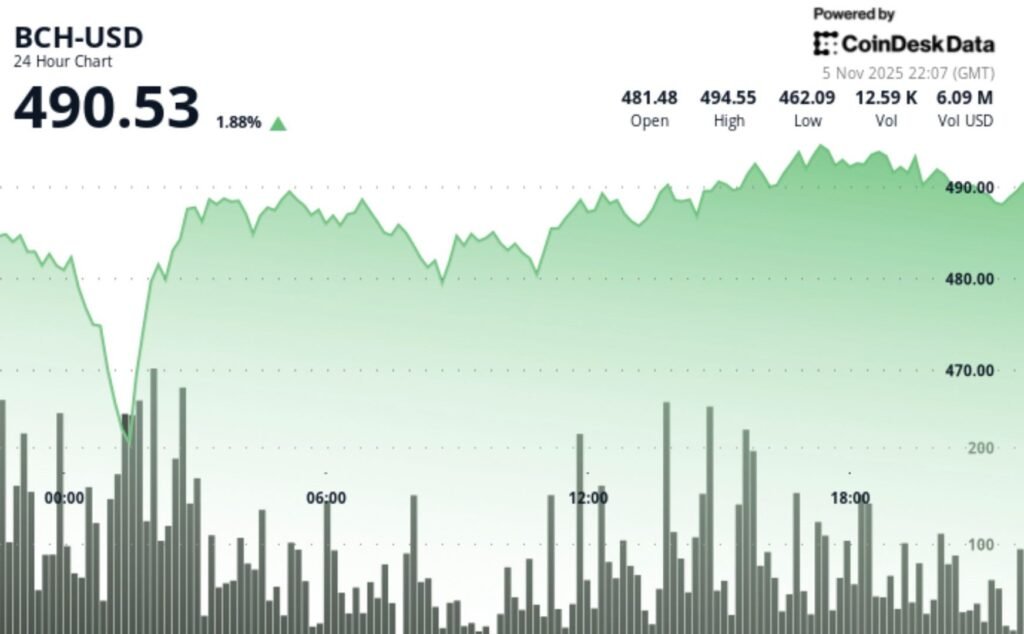

European session buying lifted volume 78% above the 24-hour average as bitcoin cash set higher lows at $462.67, $474.27 and $479.03.

What to know:

- Breakout above $487 occurred during the European session on sustained buying, sending BCH up 3.3% to $491.80.

- Volume peaked at 33,795 units on Nov. 4 at 21:00, 78% above the 24-hour average of 13,478.

- Resistance formed near $495 including a $495.30 session high, while support sits at $490, $487 and $479.03.

According to CoinDesk Research’s technical analysis data model, BCH rose 3.3% to $491.80 after clearing $487 on above-average European session volume, posting a $33.36 range and a brief pullback from a $495.30 high that buyers quickly faded.

(Please note all timestamps are in UTC.)

Technical analysis highlights

- Price moved from $476.10 to $491.80, up 3.3%

- Intraday range measured $33.36

- Higher lows were set at $462.67, $474.27 and $479.03

- Breakout above $487.00 occurred during the European session on sustained buying interest

- Price peaked at $495.30, then slipped $3.20 to $490.14 before rebounding to $492.99

- Multiple attempts to breach $495.00 took place between 16:00 and 17:00 on Nov. 5

- Volume peaked at 33,795 units on Nov. 4 at 21:00, versus a 24-hour average of 13,478 units, a 78% surge

- The 0.65% pullback from session highs was followed by recovery above $491.00

Patterns explained

The report describes an ascending trend with a clean breakout: buyers repeatedly stepped in at progressively higher lows, price pushed through $487 with stronger participation, then a small dip was absorbed quickly, which kept momentum intact.

Support vs. resistance map

- Support: $490.00 psychological level tested during a 60-minute correction; $487.00 breakout zone; $479.03 higher low

- Resistance: $495.00 area after several rejections; $495.30 session high

Targets & risk framing

- Targets: Immediate upside target at $495.30 with breakout potential above $500.00

- Invalidation/risk: Defend $487.00 to maintain the bullish structure

- Context: Risk/reward favors continuation with a 7.0% daily range indicating strong volatility

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

Bitcoin’s Plunge Brings Strategy’s Holdings to Near Breakeven, but Key Test Lies 18 Months Ahead

Michael Saylor’s company’s balance sheet isn’t at imminent risk of collapse, but further capital-raising efforts could surely be hindered unless conditions improve.

What to know:

- Despite volatility, Strategy’s balance sheet faces no immediate stress, and the main pressure point sits about 18 months away when the first put option on the company’s convertible notes becomes exercisable.

- Performance has diverged across the preferreds, with the STRF and STRC series trading above issue, while STRK and STRD sit meaningfully below their launch prices.

- Management has multiple options should the bitcoin market remain under stress, but use of any is likely to hinder future capital-raising efforts.

Chainlink Is ‘Essential Infrastructure’ for Tokenized Finance, Says Grayscale Research

Bitcoin’s Plunge Brings Strategy’s Holdings to Near Breakeven, but Key Test Lies 18 Months Ahead

XRP Drops With Market as Bitcoin Weakness Pulls Altcoins Into Oversold Territory

As DATs Face Pressure, Institutions Could Soon Look to BTCFi for Their Next Strategic Shift

Coinbase to Add 24/7 Trading for SHIB, Bitcoin Cash, Dogecoin, and Others

Hobbyist Miner Beats “1 in 180 Million Odds” to Win $265K Bitcoin Block Using Just One Old ASIC

Hobbyist Miner Beats “1 in 180 Million Odds” to Win $265K Bitcoin Block Using Just One Old ASIC

Is Strategy Stock the Preferred Hedge Against Crypto Losses? Tom Lee Thinks So

Turning ‘$11K to Half a Billion Dollars From Trading Memecoins’: Tales From a Crypto Wealth Manager

‘Liquidity Crisis’: $12B in DeFi Liquidity Sits Idle as 95% of Capital Goes Unused

Coinbase ‘Negative Premium’ at Widest Level since Q1, Signalling Weak U.S. Demand

Aerodrome Finance Hit by ‘Front-End’ Attack, Users Urged to Avoid Main Domain

!–>!–>!–>!–>!–>

Read More

Be the first to write a comment.