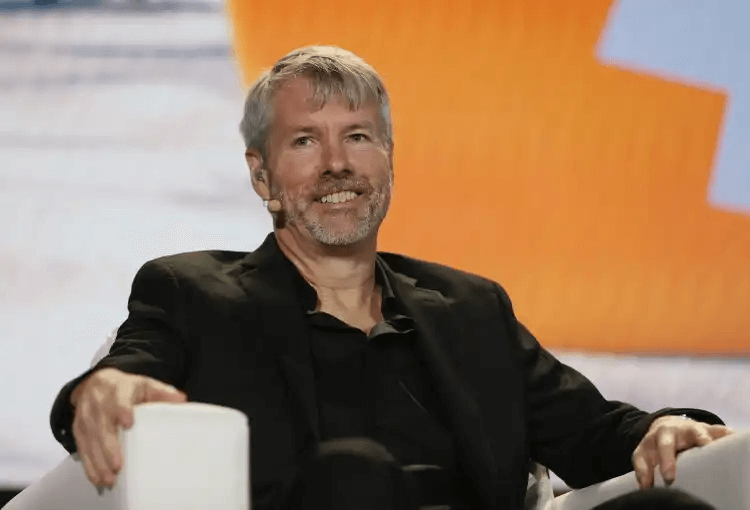

Michael Saylor Announces Plans to Raise $21 billion from Stock Sale

- Michael Saylor announced plans to raise funds to buy Bitcoin by issuing and selling $21 billion worth of MicroStrategy shares.

- The equity raise is part of a larger plan to raise $42 billion for Bitcoin purchases over the next three years.

- The at-the-market equity offering will dilute current shares by 42% of their capitalisation, which currently stands at $50 billion.

Michael Saylor, co-founder and Chairman of MicroStrategy, announced plans to raise $21 billion to buy more Bitcoin by offering more MSTR shares at prevailing market prices. The amount of shares issued would dilute the value of existing shares held by current shareholders.

Usually, this level of dilution would lead to a significant discount in stock price to retain the same overall value, which is manifest by a fall in stock prices.

However, MicroStrategy’s stock price has not fallen significantly since the announcement, due largely to its cohort of shareholders, the performance of its stock since 202, and its Bitcoin holding.

An overview of MicroStrategy’s Bitcoin purchases

MicroStrategy began buying Bitcoin in 2020, at a time when adding Bitcoin to corporate balance sheets was not as accepted as it is today. Over the last four years, the company has issued corporate debt notes to fund its Bitcoin purchases and currently holds 252,220 Bitcoin (roughly 1% of the total Bitcoins supply) worth roughly $17.6 billion.

The company’s most recent purchase was in September 2024, when it bought 7,420 Bitcoin at an average price of $61,750 per BTC, totalling $458.2 million, which it raised by offering senior debt notes.

Shareholders hope despite dilution concerns

MicroStrategy is in a unique position because the size of its Bitcoin holdings creates a correlation between Bitcoin’s price performance and that of its stock. With each major Bitcoin purchase, MSTR moves closer to being a quasi-Bitcoin spot ETF.

However, the total cost of MicroStrategy’s Bitcoin purchases hovers around $9.9 billion while the current value of the company’s holding is 95% higher than the cost price, a performance that has fueled the company’s stock rally.

MSTR, which traded around $13 in 2020 when MicroStrategy began its Bitcoin buying strategy, is currently trading at $244.50. The share price has grown 250% this year alone, outpacing Bitcoin’s 60% performance.

MicroStrategy’s capital plans and Saylor’s projections

Michel Saylor’s plan to buy $42 billion worth of Bitcoin over the next three years, fueled by a $21 billion equity raise and debt notes, could increase the company’s Bitcoin holdings by threefold, depending on th

Be the first to write a comment.