Mt. Gox confirms Bitcoin, Bitcoin Cash repayments have begun

Key Takeaways

- Mt. Gox has commenced the distribution of Bitcoin and Bitcoin Cash to its creditors.

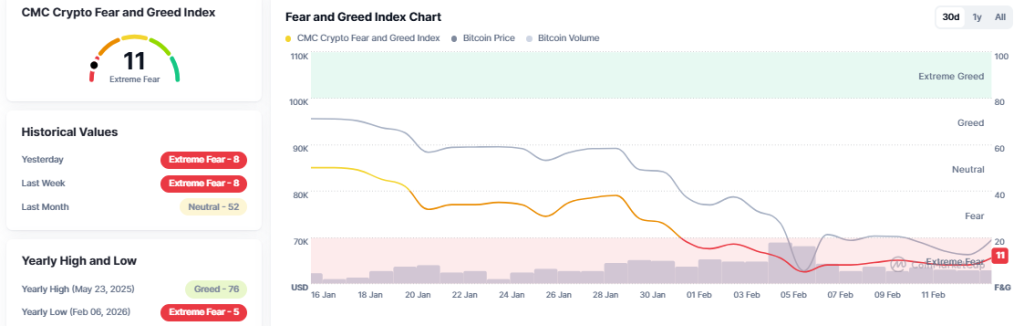

- The initiation of repayments by Mt. Gox is exerting downward pressure on Bitcoin market prices.

Share this article

Mt. Gox, the now-defunct crypto exchange, has confirmed that it started the distribution of Bitcoin and Bitcoin Cash to its creditors on Friday, according to an official document from Mt. Gox’s Rehabilitation Trustee. As noted, the repayments were made through designated crypto exchanges like Bitbank and SBI.

The confirmation came shortly after Mt. Gox’s wallet transferred 1,545 BTC, worth around $84 million, to Bitbank’s hot wallet, according to data from Arkham.

Mt. Gox initiated a series of Bitcoin transfers yesterday. A portion of their holdings was sent to a Bitbank wallet, which some believe may have been a test run ahead of a larger payout. Arkham’s data also revealed a transfer of 47,229 BTC, valued at roughly $2.7 billion, from Mt. Gox’s wallet to a new destination yesterday night.

The repayment process began this July, following last month’s announcement of the repayment plan.

Mt. Gox and its place in crypto history

Programmer Jed McCaleb founded Mt. Gox in July 2010, later selling it to French developer Mark Karpelès in March 2011. Under Karpelès’ leadership, the exchange expanded its operations in Tokyo and by 2013 was handling over 70% of all global Bitcoin transactions.

Despite its market dominance, Mt. Gox struggled with persistent security and operational issues. Between 2011 and 2013, the exchange fell victim to multiple hacks and transaction malleability attacks, leading to frequent trading and withdrawal suspensions. These recurring problems gradually eroded user trust and resulted in significant liquidity challenges.

The exchange’s troubles culminated in early 2014 when it suspended all bitcoin withdrawals, citing technical difficulties. This move fueled speculation about the company’s solvency. On February 24, 2014, Mt. Gox ceased operations entirely, shutting down its website and halting all trading activities.

The recent move to release funds to former users has induced additional selling pressure in the Bitcoin market, reflecting the ongoing impact of the exchange’s historical significance. At the time of writing, Bitcoin is trading at the $54,200 level.

Share this article

?xml>

Be the first to write a comment.