XRP Slides 4% Amid Bitcoin Sell-Off, but Cup-and-Handle Setup to $5 Intact

XRP Slides 4% Amid Bitcoin Sell-Off, but Cup-and-Handle Setup to $5 Intact

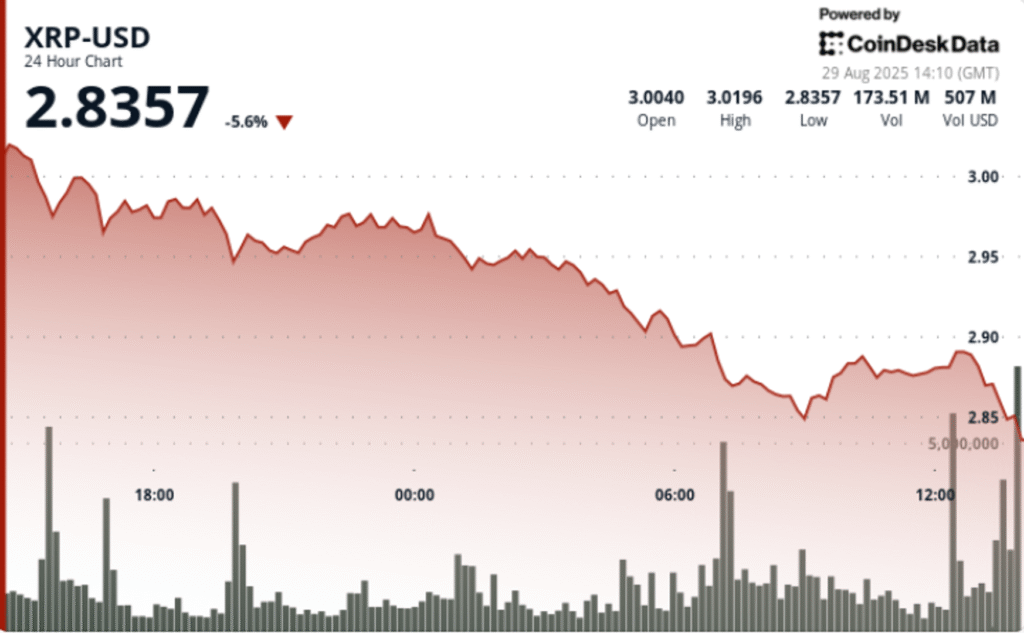

Token retreats from $3.02 resistance in a volatile August 28–29 session as distribution pressure meets fresh accumulation at $2.85–$2.86 support.

What to know:

- XRP trades under regulatory uncertainty as the market anticipates SEC decisions on crypto ETFs.

- Active XRP Ledger addresses increased by 20% ahead of the September 12 Decentralized Media launch.

- Linklogis’ integration with the XRP Ledger boosted its equity by 23%, indicating rising institutional interest.

News Background

- XRP continues to trade under regulatory uncertainty as markets await key SEC decisions on spot crypto ETFs in September.

- Active XRP Ledger addresses rose 20% over three days, signaling renewed network engagement ahead of the planned September 12 Decentralized Media launch.

- Chinese fintech firm Linklogis integrated its trillion-dollar supply-chain financing platform with the XRP Ledger, sending its equity 23% higher and adding to signs of institutional interest.

- Whale activity remains elevated: 900 million DOGE worth $200 million moved to Binance earlier this week, highlighting ongoing large-holder repositioning across memecoins.

Price Action Summary

- XRP declined 4.30% during the 24-hour period from August 28 at 13:00 to August 29 at 12:00, dropping from $3.02 to $2.89.

- The token traded in a $0.17 band (5.75% of session peak), sliding sharply from $3.02 to $2.84 during the initial sell-off at 15:00 GMT on Aug. 28.

- Accumulation interest surfaced around $2.85–$2.86, with volumes above the 75.9 million daily average during the 07:00–09:00 GMT recovery phase.

- In the final hour (11:56–12:55 GMT on Aug. 29), XRP rebounded from $2.87 to $2.89, briefly touching $2.91 at 12:31 on a 19.6 million surge.

Technical Analysis

- Support: Strong base forming at $2.85–$2.86; intraday stability at $2.88 underscores accumulation.

- Resistance: Selling pressure remains at $3.02, with $2.91 acting as a near-term ceiling after the bounce.

- Momentum: RSI steady in the mid-50s after a dip to 42, reflecting neutral-to-improving momentum.

- MACD: Histogram is converging toward a bullish crossover, suggesting potential upside follow-through.

- Patterns: Bearish trajectory from $3.02 capped rallies, but a cup-and-handle setup remains on watch with technical targets in the $5–$13 zone if momentum extends.

- Volume: 273M tokens traded during peak session activity; 19.6M surge at 12:30 GMT confirmed institutional buying at $2.88–$2.91.

What Traders Are Watching

- Ability to defend $2.85–$2.88 support as the foundation for further recovery.

- Break above $3.02 resistance could open a path toward $3.20 in the near term.

- Bearish scenario points to $2.80 if $2.85 fails.

- Network growth (20% jump in active addresses) and Linklogis’ integration with XRPL as fundamental tailwinds.

- Monitoring whether institutional accumulation offsets whale-driven distribution in coming sessions.

Di più per voi

Bitcoin Crosses $112K As Traders Brace for Data Week; Rotation Lifts SOL, DOGE

Crypto spent the week in neutral, with bitcoin lagging peers and gold. Positioning remained cautious ahead of CPI, PPI, and central-bank headlines, while pockets of rotation pushed SOL and DOGE higher.

Cosa sapere:

- Bitcoin remained around $111,500 as traders evaluated a light spot-ETF tape against a busy macroeconomic calendar.

- Dogecoin surged to 24 cents, outperforming major cryptocurrencies ahead of the first-ever memecoin ETF launch in the U.S.

- Investors are navigating between bearish sentiment and potential missed opportunities, with key focus on U.S. economic data and central bank decisions.

Bitcoin Crosses $112K As Traders Brace for Data Week; Rotation Lifts SOL, DOGE

Metaplanet to Raise $1.4B in International Share Sale, Stock Jumps 16%

Bitcoin Retakes $112K, SOL hits 7-Month High as Economists Downplay Recession Fears

Kraken Expands Tokenized Equities Platform, xStocks, to European Investors

Polymarket’s Top Trader Bets on a 50bps Fed Rate Cut Next Week

What Next as XRP Slumps After Failed Breakout Above $3

Bitcoin Retakes $112K, SOL hits 7-Month High as Economists Downplay Recession Fears

Metaplanet to Raise $1.4B in International Share Sale, Stock Jumps 16%

Kraken Expands Tokenized Equities Platform, xStocks, to European Investors

Asia Morning Briefing: Bitcoin’s Calm Masks Market Tension Ahead of Fed and CPI

Polymarket’s Top Trader Bets on a 50bps Fed Rate Cut Next Week

Bitcoin Miners Surge Following Microsoft’s $17.4B AI Bet

!–>!–>!–>!–>!–>!–>!–>!–>!–>!–>

Read More

Be the first to write a comment.