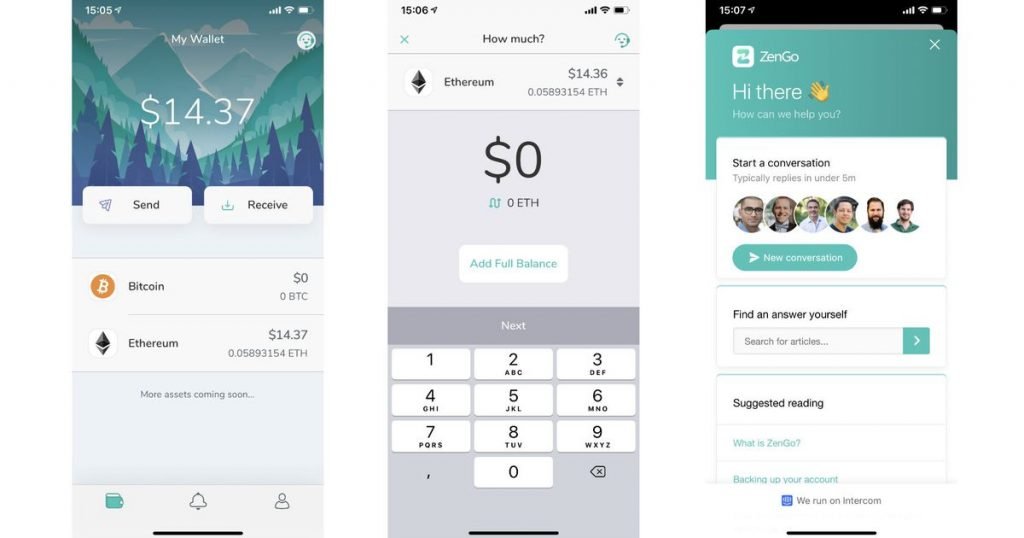

ZenGo crypto wallet changes the game by being dead simple to use

Cryptocurrency wallet software can be intimidating to use. With crypto, you are your own bank, which sounds great until you realize that you and you alone are responsible to keep your money safe.

In practice, this typically means you need to go through the process of creating a new wallet, setting up a password and writing down a lengthy list of words known as a seed phrase. You also have to store the seed phrase in a secure manner, because it’s the only backup for your money in case something goes wrong with the wallet.

Israel-based startup ZenGo has just launched a cryptocurrency wallet that uses some clever cryptography to make this process much simpler.

SEE ALSO: Facebook talks to U.S. regulator about its cryptocurrency

A very short primer: A cryptocurrency wallet is, essentially, a pair of public and private cryptographic keys. The public key is your cryptocurrency address (technically, it’s a part of the address but let’s keep it simple), the same one you use for receiving funds. The private key is a long string of symbols that lets you spend the funds residing at that address.

The private key is simple but impractical to use on an everyday basis. If someone takes a photo of it, or hacks your PC or phone and grabs it, they can spend your cryptocoins at will. This is why we have wallet software, which rarely (if ever) actually shows or requires you to type in your private key. Instead, you choose some sort of password to protect your funds, but your private key remains in your possession, typically as the seed phrase mentioned above. So if your phone or PC gets stolen, you can reinstall the wallet software, punch in the seed phrase, and access your money.

The seed phrase, while a little bit easier to write down than the private key, is also long and

Be the first to write a comment.