10 Cyber Security trends to look out for in 2018

It is still too early to predict whether 2018 will be safer than 2017 when it comes to cybersecurity. It is fair enough to say that this question has been raised since last year wasn’t the best for many IT companies and global organizations. However, experts have already made a few predictions for 2018 based on the current cyber security trends. Let’s have a look at them one at a time:

1) A.I. Cybersecurity

Artificial intelligence has come a long way from where it once started. AI-powered programs today are capable of monitoring events which can help identify incoming cyber attacks. However, according to experts, cybersecurity AI may beat the purpose for what it is designed as it may be able to assist hackers in carrying out even more complex attacks. Some have even called them double-edged swords.

2) IoT (Internet of Things) with improved security features

Internet of Things, which is a growing topic of conversation today, is the correlation of computing devices with physical objects via the internet, such that they are able to send and receive data. From Apple Watches to Nest Thermostats, IoT will see a growth like never before with some professionals estimating over 20 billion connected units by the end of this year. If anything can cause an obstacle in this positive transformation, it would certainly be a collapse of security. After the massive amounts of DDoS attacks in 2017, security leaders have gotten a heads up about possible compromises through IoT devices. We certainly can expect a good amount of improved security features associated with IoT devices this year.

3) Biometric Authentication

Let’s face the truth! Usernames and Passwords suck! They are impersonal and put a burden on users in remembering them. With the introduction of fingerprint sensors on mobile phones and the huge success of Apple’s FaceID, we should expect more of biometric-enabled devices in the coming months. While it might be a little too early to expect biometric authentication in all our daily accounts, we might see a start of a new identity authentication evolution.

4) GDPR – General Data Protection Regulation (GDPR)

General Data Protection Regulation is probably something we haven’t heard till lately. GDPR is a set of regulations, expected to go into effect on May 25, 2018, that is intended to strengthen data protection for all individuals and businesses within the European Union. While its to early to predict anything, the GDPR is expected to have a significant influence on the digital sector of Europe.

5) Cyber attacks on global organizations

Mainframes are the backbone of most global organizations. These are the computers responsible for processing bulk data such as statistics, census, bank operations and ATM transactions. While security firms focus more on protecting mobile and computer systems, mainframes are being overlooked.

6) Cloud security

With the automotive industry recently joining the cloud family, providing users with state of the art navigation systems, it is predicted that there would be huge investments to secure the cloud environment. The priority would be to generate trust among cloud users to store data without hesitation on servers they don’t own.

7) Increase in Ransomware

Ransomware, as the name suggests, is a malicious virus where the victim’s access to information is blocked unless a ransom is paid. Typically, the ransom amount is in hundreds or thousands of dollars although sometimes even higher. Last year itself, there has been an increase of 36 percent of ransomware and the trend doesn’t seem to slow down. The Petya Ransomware that caused mayhem in almost all of Europe and other parts of the world in 2017 is a warning to expect more.

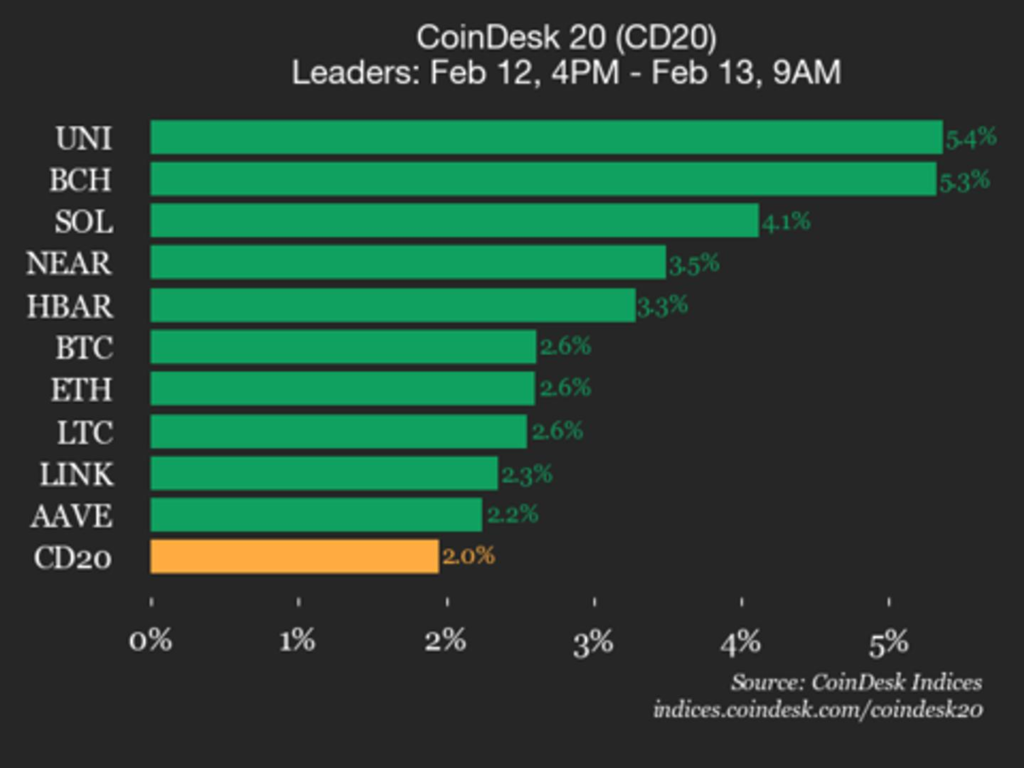

8) Cryptocurrencies and Blockchains

Cryptocurrencies have been an evolution. However, they do have certain drawbacks, especially when it comes to bitcoins. Since Bitcoin transactions do not require identity verification and can be done anonymously, they have fueled events of ransom threats like never before.

This is predicted to continue growing as we progress into 2018. Cryptocurrencies have been built around the concept of blockchains and this technology is just limited to them. While it is tough to predict what other implications blockchains might have on cybersecurity, some educated predictions say they could be used in decentralizing access control and improving identity management.

9) Threats to serverless apps

While serverless apps have some considerable advantages, they are potential threats to cyber-attacks, the reason being – the lack of servers. It might seem counter-intuitive at first as for the most part, the security of the serverless application is controlled by the customer itself. However, that isn’t always the best idea, as a users device might not always be the safest location to store important information.

10) Safer for everyone

2017 was a year when we experienced cyber attacks we have never seen before. Such events have pushed security experts to carry out careful investigations to make sure certain cybercrimes do not repeat. Governments and tech-firms have invested an immense amount of money to tackle a problem that caused more than $3 trillion of damages worldwide just last year. The increased amount of general awareness and the proper preparedness from various authorities should make the internet a much safer place for everyone.

Be the first to write a comment.