Break up the Telecom Giants

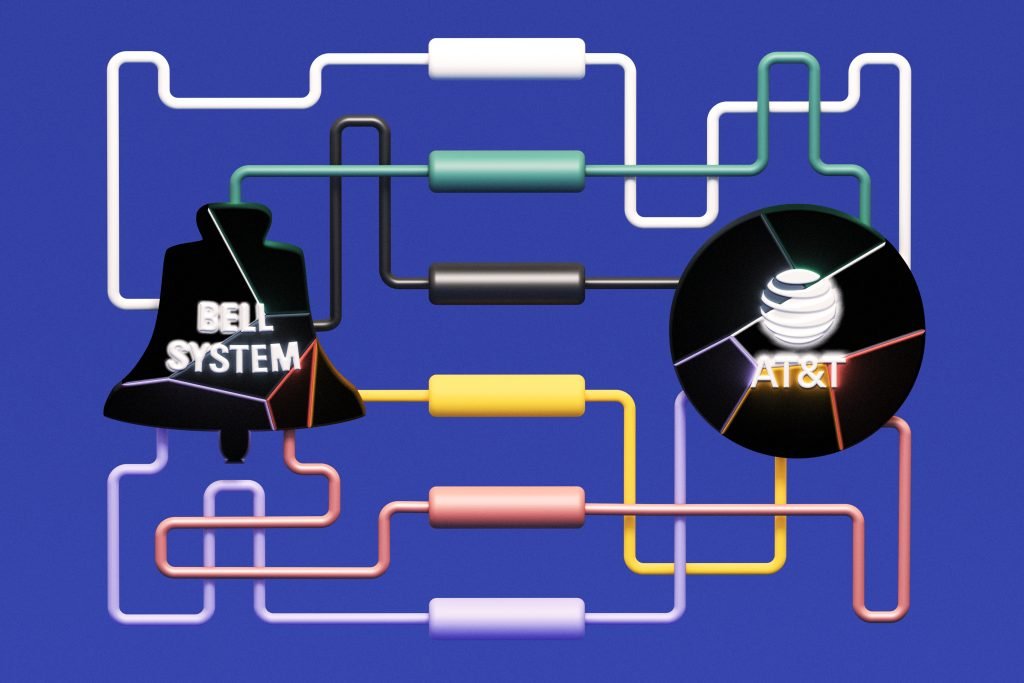

Early in February, a strange and humbly formatted quarter-page ad appeared in The Wall Street Journal. It was an open letter to AT&T CEO John Stankey from one Aaron M. Epstein of North Hollywood, California, who helpfully included his email address and phone number, should Stankey decide to get in touch about fixing his slow DSL connection.“Although AT&T is advertising speeds up to 100 MBS for other neighborhoods, the fastest now available to us from ATT is only 3 MBS,” Epstein wrote. “Your competitors now have speeds of over 200 MBS. Why is AT&T, a major communications company, treating us so shabbily in North Hollywood? Sincerely, Aaron M. Epstein, an AT&T customer since 1960.” As his sign-off suggested, Epstein is quite old—90 years old, in fact. And, as he told Vice’s Motherboard in an interview, AT&T was part of the fabric of his life well before he was a paying customer. “My family,” he said, “has had Bell service since I was born in 1930.”For nearly a century, American Telephone and Telegraph’s “Bell System”—a conglomerate that took its name from telephone inventor Alexander Graham Bell—essentially controlled telephone service in the United States. In 1984, after decades spent fighting the company, regulators finally succeeded in breaking up AT&T’s extraordinary monopoly with a federal consent decree that divided the Bell System into seven regional companies, or “Baby Bells.” Since then, those companies have gathered themselves back up into three: Lumen Technologies, Verizon, and the new AT&T, a multi-industry behemoth.This AT&T is still a major telephone company, with 100 million total customers. Unfortunately for Mr. Epstein and his 15.4 million fellow subscribers, AT&T is also America’s third-largest broadband internet service provider. And its 2015 purchase of DirecTV has made the company the nation’s second-largest provider of paid television. (In February, AT&T spun off DirecTV, but it still controls 70 percent of the company.)When it acquired Time Warner in 2018, AT&T gained control over many of the things DirecTV’s users and the rest of the country might want to watch. Need to catch up on the news? Maybe hear from some pundits on how large and terrifyingly powerful social media companies have become? You’ll find them on the AT&T subsidiary CNN. How about some entertainment—a hit network series like Young Sheldon or classics from HBO like The Sopranos or Game of Thrones? All of those shows belong to AT&T. Want a movie instead? AT&T’s subsidiary the Warner Bros. Pictures Group produces and distributes, by its own count, 18 to 22 major films a year—from superhero flicks like Zack Snyder’s Justice League to awards season favorites like the Fred Hampton biopic Judas and the Black Messiah—and holds another 10,000 films in its catalog.As big as it is, AT&T has another huge and powerful rival in Comcast—the country’s largest broadband internet provider and paid television provider, one of the biggest telephone providers, and the parent company of both NBCUniversal, which includes subsidiaries NBC, MSNBC, CNBC, Telemundo, and Universal Pictures, and Sky, one of Europe’s largest media companies. There are other major conglomerates in the media and telecommunications industries—Disney, ViacomCBS, Fox, Charter—but the power AT&T and Comcast hold over both content and the means of distributing content sets them apart.And yet the telecoms rarely enter our debates over “Big Tech” and corporate power in the internet age. Google, Microsoft, Amazon, and Apple have shaped the basic nuts and bolts of the internet. Facebook’s dominance over social media and its share of the online advertising market have made it another giant in the eyes of many. But the telecoms, which hold the keys to the internet itself for millions of Americans, have accrued more than enough power, online and off, to be just as worthy of concern and scrutiny as all of those Silicon Valley firms. The telecoms are tech companies, and they are big ones—so big that they’ve become much larger than tech itself.When Ajit Pai’s Federal Communications Commission ended net neutrality in 2017, telecoms were given the freedom to speed up, slow down, or apply special prices to content on the internet for political, financial, or any other reasons salient to their executives. AT&T, for instance, has already exempted its HBO Max service from the data caps it imposes on competitors such as Netflix. This is where much of the power on the internet actually resides. Without net neutrality, internet service providers can simply cripple or boost entire websites as they see fit. Hot takes, viral videos, family photos, offbeat memes, and dangerous misinformation might get posted on Facebook and Twitter, where moderators can scrutinize their content, but both companies functionally sit atop a vast infrastructure they don’t actually command.For customers, access to that infrastructure is essentially segregated. According to a report last year from the Communications Workers of America and the National Digital Inclusion Alliance, more than a quarter of the households in AT&T’s network fail to meet the FCC’s standard for broadband speed. And despite billions in tax breaks and years of vaunted investments in upgrading its network, less than a third of AT&T’s households had fiber internet access in 2019. Epstein got a response from Stankey’s office and AT&T’s technicians not long after his ads ran, but in general, those lucky enough to receive upgrades have been the beneficiaries of what critics call “digital redlining.” The median income of households with fiber access is 34 percent higher than the income of households with just DSL.The internet is, again, only part of the telecoms’ kingdom. And we shouldn’t understate the importance of its other provinces. Take the news media. Much has been made of the ways in which social media and online journalism may be reshaping our politics for the worse. And it’s true that both are now important parts of the public’s information diet: According to Pew, 18 percent of Americans get their political news mostly from social media, and another 25 percent get it from news websites and apps. But the primary source for 45 percent of the country is still television. And even that figure understates the reach of traditional media. Much of the news that appears for discussion on social media is heard first on the networks or their web presences, and AT&T, for instance, owns CNN.com, the most visited news site in America.It probably shouldn’t surprise us that cable news pundits have more to say about regulating Facebook and Twitter than they do about breaking up the conglomerates that employ them. But can they be broken up? Again, AT&T was broken up once before. Its gradual reconsolidation and entry into new industries coincided with a major rewrite of our communications laws. While the Telecommunications Act of 1996 was putatively aimed at spurring more robust competition among cable, broadcast, and radio companies through deregulation, precisely the opposite happened. And now, 25 years later, the law is overdue for a rewrite—the internet, the explosion of the mobile phone industry, and other changes have rendered the communications and media landscapes all but unrecognizable.Fully restoring net neutrality by reclassifying internet service providers as “common carrier” utilities, like telephone providers, will be an easier lift with Democrats in control of the FCC. But last year, Bernie Sanders ran on a broader and more transformative goal—providing high-speed broadband for all through public investment. His plan would require all internet service providers to offer a basic internet plan, and preempt state laws limiting publicly owned broadband systems.Sanders’s proposal would bring us close to establishing quality, high-speed internet access as a true, equally accessible public good. He has also called for breaking up cable and internet monopolies and banning internet service providers from providing content. Both ideas would go a long way toward shrinking the telecoms.It’s also possible that telecom executives might do some of that work themselves. AT&T may decide to spin or sell off more of its subsidiaries. But the telecoms will never fully abdicate their places atop our information economy without government action. Our lawmakers should hop to it and bring our communications policies up to speed.

Read More

Be the first to write a comment.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take